how to file 1095 b electronically

1 Enter Federal Tax Withheld Details 2 Enter State Tax Withheld Details 3 Review your Form 1099-B 1096 4 Transmit your Form 1099-B to the IRS 5 Recipient Copy OnlinePostal Frequently. For example if you must file 500 Forms 1095-B and 100 Forms 1095-C you must file Forms 1095-B electronically but you arent required to file Forms 1095-C electronically.

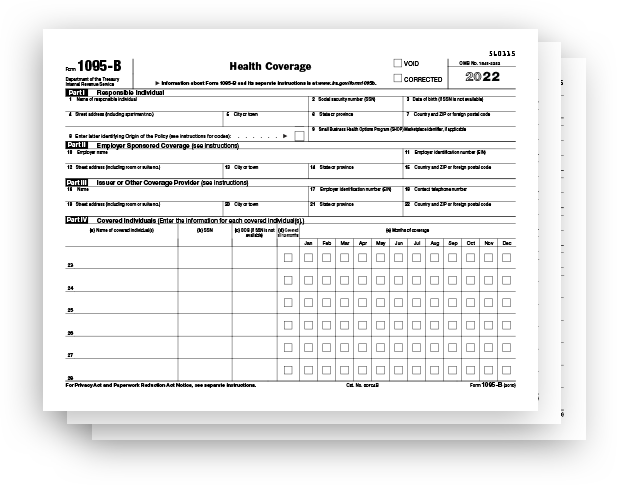

B1095b05 Form 1095 B Health Coverage Nelcosolutions Com

Let our trained staff import your data from excel print and mail if necessary and electronically file on your behalf.

. E-file with the IRS and the State. Change the Transmission Type from Original to Correction 1095-C Records or Correction 1095-B Records. ACAwise will handle ACA Code Generation Form Generation IRS E-Filing State E-Filing Recipient Copy Mailing Get Started Now What is the purpose of ACA Form 1095-B.

Send Forms to you for Review. If you are filing on paper use Copy A. Following recently announced regulation changes the IRS has set the deadline for furnishing form 1095-C to employees on March 2 2022 marking a permanent 30-day extension.

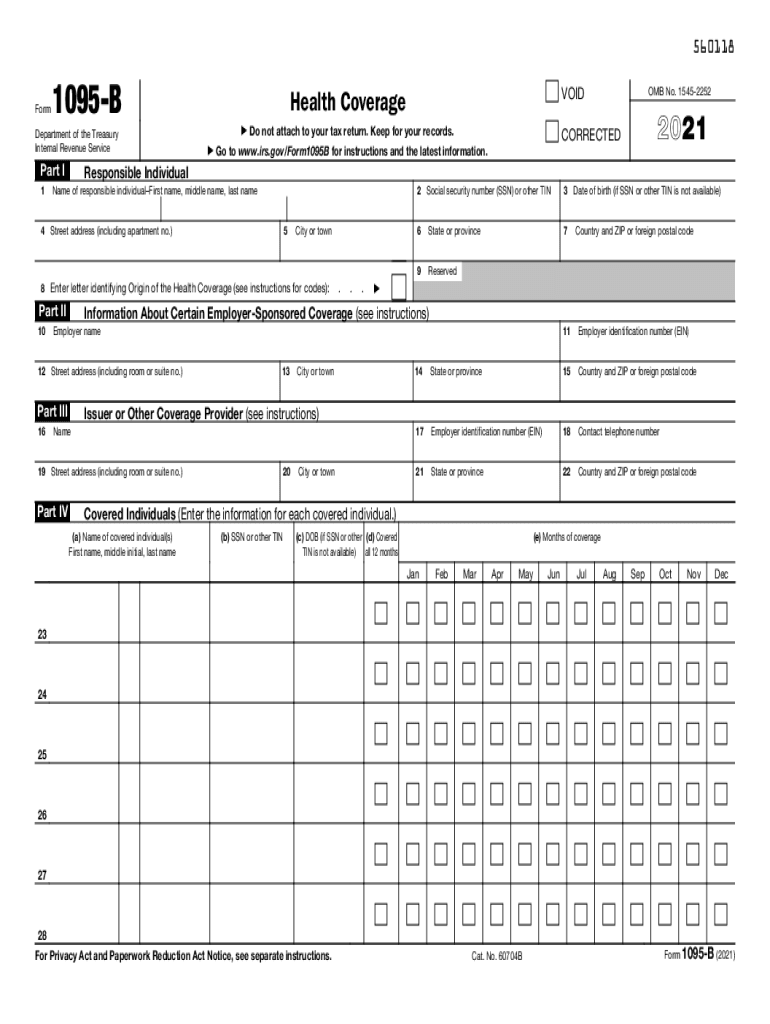

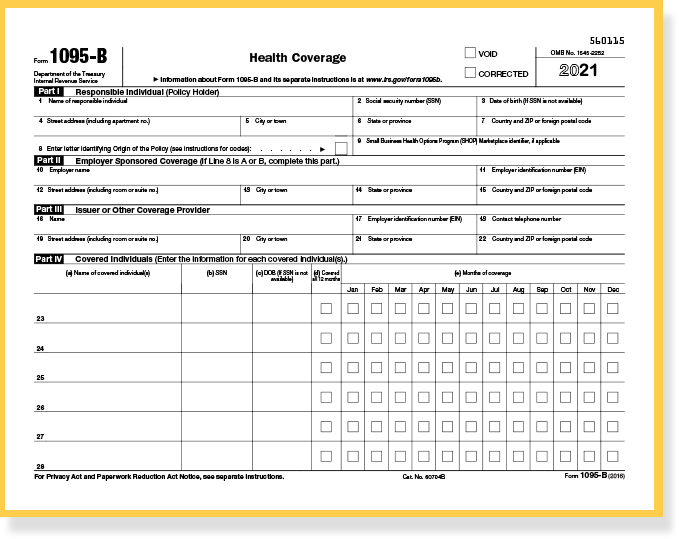

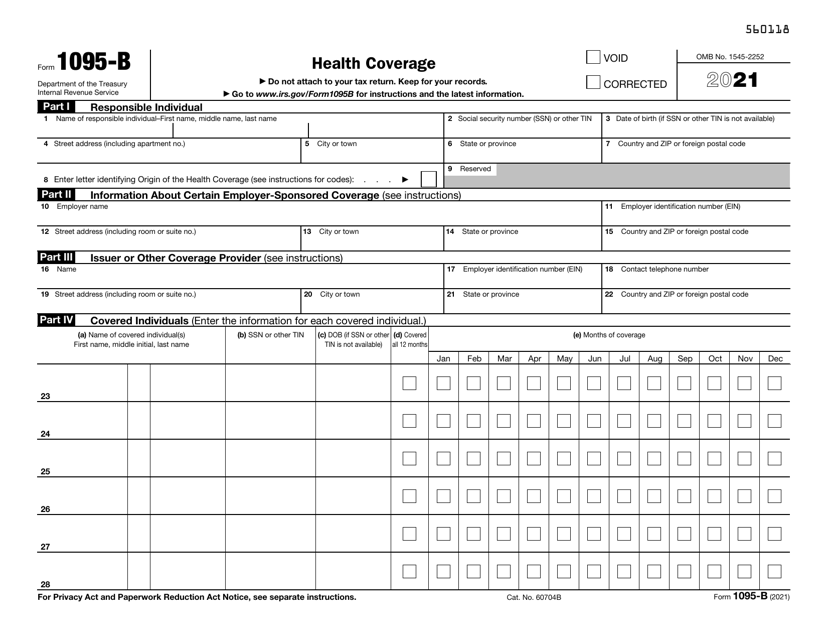

Name TIN Date of Birth if SSN or other TIN is not available covered months Review and. ACA Codes and amounts Covered Individual Details. Form 1095-B is used to report certain information to the IRS and to taxpayers about individuals who are covered by minimum essential coverage and therefore are not liable for the individual shared.

Check them for accuracy if you receive them and. How do I electronically file Forms 1094-C and 1095-C with the Internal Revenue Service IRS. The form 1095-B is for information only it does not need to be input into TurboTax.

Everything required for Employers TPAs to E-File ACA Forms 1095-BC. Get Started with TaxBandits file in minutes. In addition to submitting the form to the IRS you must also provide the recipient copies Copy B and Copy 2 to the independent contractor.

In the top left corner you will see this. Insurance companies outside the Marketplace Government agencies such as Medicare or CHIP. Click on File Information Returns Electronically and a box will pop up.

We will take care of the rest. Simply Sign Up and upload your employees payroll and health benefits data. How to E-File Form 1095-B Online for 2021 with TaxBandits.

Name EIN and Address Employee Details. The 1095-B is sent by the Health Care Providers such as. How to E-file Form 1099-B Online for 2021 with TaxBandits.

Name SSN and Address Employee Offer of Coverage details. Distributing Statements to Individuals. Electronically-filed 1099-B forms are directly transmitted to the IRS from Tax1099.

Office of Personnel Management. Perform Various Data Validations. Form 1094-B is a summary form that is filed with form 1095-B electronically or on paper.

Please call our sales office at 480 706-6474. 1 Choose Form 1095-B 2 Enter employer Insurer details 3 Enter Form Information 4 Transmit your Form to the IRSState 5 Deliver Recipient Copy OnlinePostal Are you ready to file your 1095-B Forms. For electronically filing 1099-MISC visit eFile360 e-filing service.

Create the data and manifest file. Form 1095-B or a similar statement must be provided to a responsible individual for whom a Form 1095-B was submitted to the IRS. Employers filing 250 or more 1095 forms must file electronically.

During the tax season taxpayers who have non-Marketplace health insurance their plan wasnt purchased on healthcaregov or a state Marketplace may receive the new Forms 1095-B or 1095-C these are receipts from private insurers or employers confirming you had or were offered coverage. E-file ACA Form 1095-B Now If you choose to paper file ACA Form 1095-B download the ACA Form 1095-B fill in the necessary details and then send it to the IRS by the address mentioned here. As another example if you have 150 Forms 1095-B to correct you may file the corrected returns on paper because they fall under the 250 threshold even if you originally filed 250 or more Forms 1095-B.

Generate Line 14 16 Codes. The responsible individual is the person who enrolls one or more individuals in minimum essential coverage and may be the primary insured. A provider must provide a statement to the individual to whom the coverage is provided.

We can electronically file prior year 1095-B or 1095-C forms using our TCC number. Simple steps to file 1095 electronically Employer Details. 4 Transmit your Form 1099-B to the IRS.

Form 1095-B is used by the IRS to determine if an individual is eligible for premium tax credit. 2 Enter State Tax Withheld Details. Form 1095-B is used by providers of minimum essential health coverage to file returns reporting information for each individual for whom they provide coverage.

If your correction comes back as Accepted your done. Providers must file this form for each individual to whom they have provided insurance coverage within the year. The deadline for filing forms with the IRS is February 28 2022 for those who choose to file paper copies and March 31 2022 for those choosing to file electronically.

Directions for filing can be found at the IRS website. E-filing or electronic filing is an online method for filing 1095-B Form. You will receive IRS acknowledgement of your eFile by email within 3 -.

We can help eliminate the stress of filing information returns by providing complete secure outsourcing solutions. The 1095-B form is sent to individuals who had health insurance coverage for themselves andor their family members that is not reported on Form 1095-A or 1095-C. IRS Form 1095-B is used for reporting information to the IRS and to taxpayers about individuals not covered by the minimum essential healthcare coverage.

Generate 1094-BC and 1095-BC Forms.

Irs E Filing Deadline March 31 2022 Aca Gps

2021 Form Irs 1095 B Fill Online Printable Fillable Blank Pdffiller

Aca Form 1095 B Filing Instructions For Health Coverage Providers

Get And Sign Form 1095 B Health Coverage 2021 2022

Aca Update Form 1095 C Deadline Extended And Other Relief

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Irs Drafts Of New 2016 Forms 1095 C 1094 C Leavitt Group News Publications

1094 B 1095 B Software 599 1095 B Software

Healthcare Form 1095 B Clarity Software Solutions

1095 B 2021 Public Documents 1099 Pro Wiki

How To Efile Prior Year 1095 B 1095 C Data Air

Irs Form 1095 B Download Fillable Pdf Or Fill Online Health Coverage 2021 Templateroller

1094 B 1095 B Software 599 1095 B Software

Download Instructions For Irs Form 1094 B 1095 B Pdf 2020 Templateroller